Canada, renowned for its world-class education system and immigration opportunities, is an excellent choice for career development and long-term settlement. Its top-tier universities, cultural diversity, and welcoming community make it a sought-after destination for students worldwide. Despite being perceived as expensive, the exquisite experience justifies the cost. With reasonable tuition fees and living expenses, Canada ensures a quality lifestyle for international students. Get answers to all your queries about the cost of living in Canada in one place.

Explore our blog to find detailed information on the estimated living expenses in Canada for Indian students, along with money-saving hacks to help you manage your cost of living effectively.

Tips For Saving Money In Canada

Canada can be pricey for international students, necessitating careful budgeting. Prioritize spending and manage finances wisely to navigate the high cost of living. Consider the following strategies to mitigate expenses.

- Student Cards: Utilize special discounts offered with student cards at bookstores, departmental stores, public transportation, and some restaurants to cut down costs.

- Part-time Jobs: Seek on-campus or work-study jobs to cover daily expenses. International students are allowed a maximum of 20 hours per week for part-time work.

- Scholarships: Explore and apply for the approximately 800 scholarships available for international students in Canada. These scholarships not only cover tuition but also assist with travel, insurance, and living expenses.

Average Living Expenses In Canada

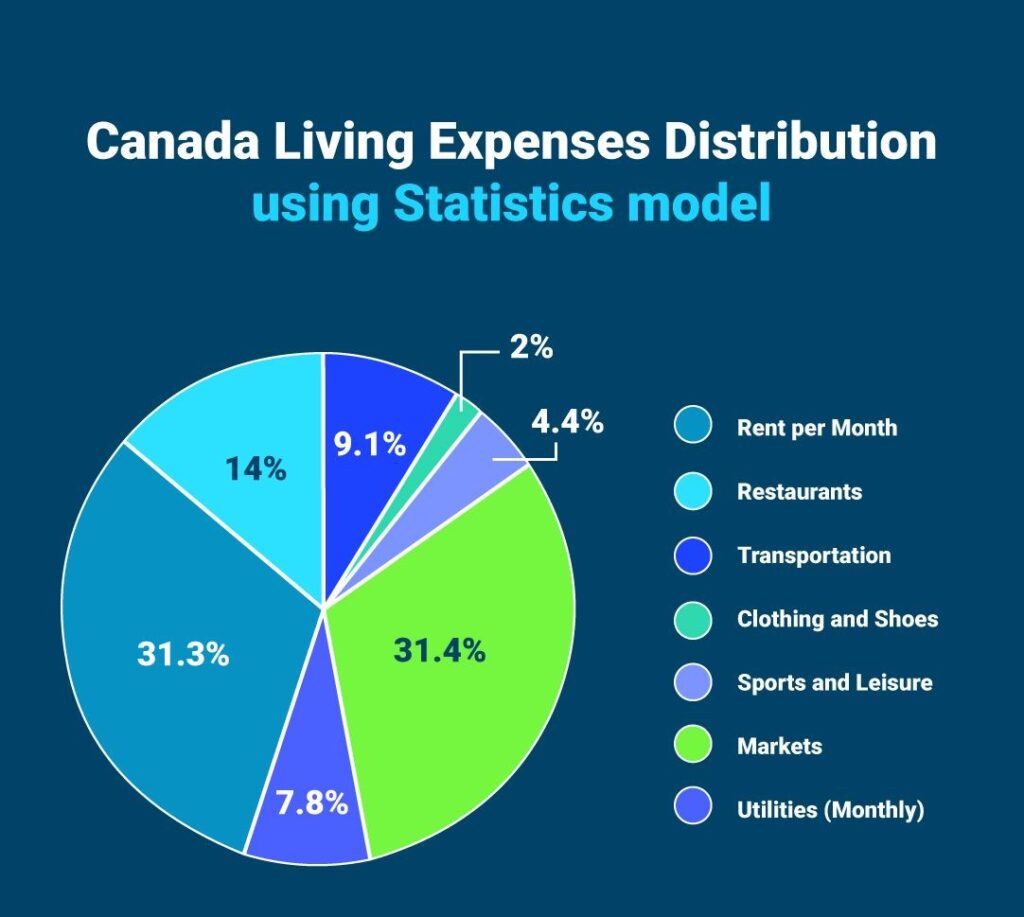

Students should set aside money for day-to-day and recurring expenses, including accommodation, food, utilities, transportation, clothing, travel health insurance, and entertainment. International students may need between 9.03 lakhs to 12.05 lakhs to cover these costs. The average annual cost of living in Canada is around CAD 18,340 (INR 11,14531). Monthly expenses, excluding rent, are estimated to be INR 68,792 (C$1,132 per month). With rent, monthly expenses can be $1,708 per person and $3,911 for a family of four. Applying for an International Student Identification Card upon arrival can provide additional benefits for managing living expenses in Canada.

Housing

| City District | Rent for 1 Bedroom (CAD) | Rent for 2 Bedroom (CAD) | Rent for 3 Bedroom (CAD) |

|---|---|---|---|

| Toronto | 1755 | 2331 | 2900 |

| Vancouver | 1925 | 2600 | 3400 |

| Montreal | 1375 | 1699 | 2100 |

| Ottawa | 1400 | 1700 | 2062 |

Travel

Transportation costs in major cities are lower due to accessible transit options. Student commute expenses vary based on on-campus or off-campus residence. Public transportation options include subways or commuter trains, with one-way fares costing a few dollars and monthly passes ranging from CAD 80 to CAD 150.

| Transportation | Average monthly cost (CAD) |

|---|---|

| Subway | 65- 99 (monthly pass) |

| Buses | 100- 150 |

| Taxi (up to 1km) | 2.00 |

| Taxi 1-hour waiting (normal tariff) | 34.00 |

| One-way ticket (local transport) | 3.25 |

| Gasoline (1 litre) | 1.59 |

Food

For food and other daily expenses, excluding accommodation, the average cost of living in Canada for international students typically ranges between CAD 200 and CAD 300.

See the table below for food expenses in Canada:

| Food Items | Cost (CAD) |

|---|---|

| Milk (regular), 1 litre | CAD 2.76 |

| Rice (white), 1 kg | CAD 4.40 |

| Loaf of Fresh White Bread (500g) | CAD 3.27 |

| Eggs (regular) (12) | CAD 4.29 |

| Local cheese (1 kg) | CAD 1 4.79 |

| Apples (1 kg) | CAD 5.06 |

| Banana (1 kg) | CAD 1.86 |

| Chicken Fillets (1 Kg) | CAD 14.86 |

General Expenses

| General expenses | Weekly | Yearly |

|---|---|---|

| On-campus Rent | CAD 600 | CAD 7,200 |

| Public Transit Pass | CAD 40 | CAD 480 |

| Mobile phone (basic package) | CAD 30 | CAD 360 |

| Groceries/Food | CAD 300 | CAD 3,600 |

| Entertainment/Clothes/Gifts | CAD 80 | CAD 960 |

| Car: Fuel | CAD 200 | CAD 2,400 |

Average Living Expenses Per Month

| Factors | Average Cost of Living in Canada Per Month |

|---|---|

| Accommodation | CAD 400 – CAD 600 |

| Food | CAD 200 – CAD 300 |

| Transportation | CAD 100 – CAD 250 |

| Internet | CAD 30 – CAD 50 |

| Miscellaneous | CAD 600 – CAD 700 |

Monthly Living Expenses

| Expenses | Cost (CAD) |

|---|---|

| Accommodation (shared apartments) | CAD 400 – CAD 800 |

| Travel | CAD 80 – CAD 110 |

| Food | CAD 300- CAD 400 |

| Entertainment | CAD 150 |

| Health Insurance (BC MSP Program) | CAD 74 |

| Utilities (Electricity, cooling, water, heating, garbage) | CAD 164.64 |

| Utilities (Internet – 60 Mbps or more) | CAD 78.82 |

Cost Of Accommodation In Canada

A student’s living expenses depend on their lifestyle and accommodation choice, whether on-campus or off-campus. On-campus accommodation offers shared facilities and may cost between CAD 8,000 to CAD 10,000 annually. Off-campus shared accommodation, like a shared condo, can range from CAD 400 to CAD 700 per month. Rental costs vary based on location and time of year. According to Canada Mortgage and Housing Corporation, the average rent for a two-bedroom in Canada is CAD 1,167 per month, subject to city variations.

| Accommodation Type | Average Cost |

|---|---|

| On-Campus | CAD 8000-CAD 10,000 |

| Off-Campus Shared accommodation | CAD 400 to CAD 700 |

| 1 BHK in city center | CAD 1,332 |

| 1 BHK outside the city center | CAD 1,123 |

| 3-bedrooms apartment City Center | CAD 2,718.34 |

| 3-bedrooms apartment outside of center | CAD 2,363.15 |

Cheapest Cities In Canada

Living Expenses In Toronto

The cost of living in Toronto, Canada varies based on individual lifestyles. Here are some basic living expenses in Toronto, subdivided into categories.

| Expenses | Average Cost (CAD) |

|---|---|

| Housing | 1,100 – 2,700/month |

| Internet | 60 – 115/month |

| Phone bill | 50 – 100/month |

| Tenant’s insurance | 15 – 30/month |

| Food & grocery | 340+/month |

| Transportation | 0 – 128.15/month |

| Books & supplies | 500/semester |

Living Expenses In Quebec

To study in Québec, you must demonstrate your financial capacity to cover all the costs below:

| Item | Average Cost (CAD) |

|---|---|

| Off-Campus Accommodation | 952 |

| On-Campus Accommodation | 1,067 |

| Transportation | 66 |

| Food | 649 |

| Utility | 113 |

| Entertainment | 56 |

| Groceries | 99 |

| Clothes | 87 |

| Health Insurance | 75 |

Health Insurance Costs

Under the Canada Health Act, provinces and territories must provide health insurance plans meeting specific criteria to ensure access to necessary medical services. Each province or territory decides which services are medically necessary, and supplemental health insurance covers additional services and fees, reducing costs. It can be purchased individually or provided through employment, reimbursing costs or covering them directly depending on the insurance provider.

How Much Does Health Insurance Cost?

Health insurance costs are influenced by factors like current health status, underlying conditions, age, gender, earnings, location, and desired coverage. To get an accurate estimate, consult an insurance provider or broker directly. Here’s a rough overview of potential health insurance premiums for a policyholder:

- Young individuals with good health: Lower premiums

- Older individuals or those with health issues: Higher premiums

- Desired additional coverage: Increased premiums

| Age | Low price (CAD) | High price (CAD) |

|---|---|---|

| 18 | 82.55 | 91.30 |

| 25 | 82.55 | 91.30 |

| 30 | 82.55 | 91.30 |

| 35 | 82.55 | 91.30 |

| 40 | 97.18 | 107.48 |

| 45 | 97.18 | 107.48 |

| 50 | 104.15 | 115.19 |

| 55 | 104.15 | 115.19 |

| 60 | 100.07 | 110.67 |

| 65 | 100.07 | 110.67 |

Living Expenses In Canada For Family

Best Country for Living: Canada is considered the best country globally, offering a unique culture, top colleges and universities, immigrant-friendly policies, scenic beauty, wildlife, excellent healthcare, and a reasonable budget.

Popular for Education: Many students choose Canada for graduation and post-graduation due to its supportive environment and facilities.

Living Expenses: While Canada’s living expenses may be higher than expected, they are reasonable considering the country’s overall context for residents and foreigners.

Cities with Low Cost of Living: Some cities in Canada offer a low cost of living while providing similar facilities.

Average Cost of Living for Families: The average cost of living in Canada for families depends on family size, typically ranging between 2 and 4 individuals, as nuclear families are prevalent.